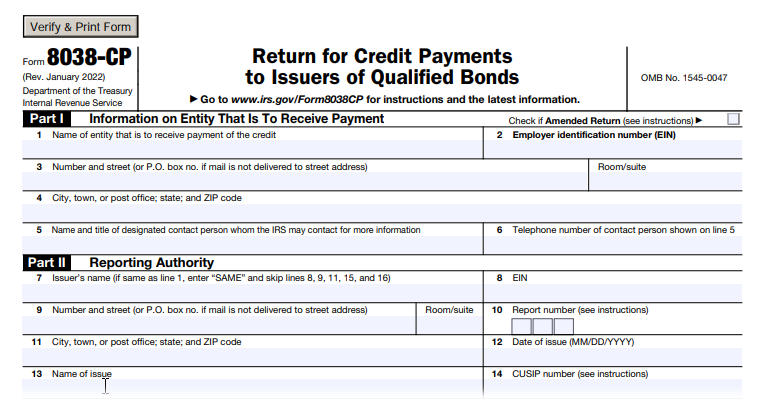

About IRS Form 8038-CP

Issuers (usually, tax-exempt organizations elected by the federal government to issue the bonds) utilize Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds, to claim payments from the federal government representing all or a portion of interest payable on the bonds.

There are 6 different types of bonds available. They are Build America bonds (BAB), New clean renewable energy bonds (NCREB), Qualified energy conservation bonds (QECB), Qualified zone academy bonds (QZAB), Qualified school construction bonds (QSCB), Recovery zone economic development bonds (RZEDB).

To claim the credit payment under section 6431(f) all specified tax credit bonds (i.e., NCREB, QECB, QZAB, QSCB), and 8038-CP Schedule A must be attached

to Form 8038-CP.

Visit https://www.expresstaxexempt.com/form-8038-cp/form-8038-cp-filing-instructions/ to Know More.

Benefits of Filing Form 8038-CP with our Software

Direct Form Entry Method

Includes Schedule A

Live Customer Support

Additional User to Manage Accounts

Deadline to file Form 8038-CP

For fixed rate bonds, IRS Form 8038-CP must be filed no later than 45 days before the interest payment date. However, Form 8038-CP must be submitted at least 90 days before the relevant interest payment date.

For variable rate bonds, 8038-CP Form may be submitted within the same deadlines as fixed rate bonds if the issuer knows the interest payment amount 45 days before the interest payment date (45 days before the relevant interest payment date but no earlier than 90 days before the relevant interest payment date). For variable rate bonds, however, a second Form 8038-CP must be filed.

Information Needed to file Form 8038-CP

To file Form 8038-CP with the IRS, you will need the following information:

- Details of the reporting entity (issuer)

- Details of the entity that is to receive the payment

- Information regarding the bond issue

- Interest payment date

- Amount of credit payment requested

To know more about Form 8038-CP filing instructions, click here.

Steps to E-File Form 8038-CP

Simplify your Form 8038-CP filing process with us by just following the simple steps.

Enter Form Details

Review your 8038-CP Form

Transmit it to the IRS